892.01 DEFINITIONS

As used in this chapter:

(a) “Deteriorated commercial property” means any industrial, commercial, or other business property owned by an individual, association, or corporation, and located in a deteriorating area, as hereinafter provided, or any such property which has been the subject of an order by a government agency requiring the unit to be vacated, condemned, or demolished by reason of noncompliance with laws, ordinances, or regulations.

(b) “Deteriorated residential property” means a dwelling unit located in a deteriorated neighborhood, as hereinafter provided, or any such dwelling unit which has been, or upon request is, certified by a health, housing, or building inspection agency as unfit for human habitation, for rent withholding or other health or welfare purposes, or has been the subject of an order by such an agency requiring the unit to be vacated, condemned, or demolished by reason of noncompliance with the applicable laws, ordinances, or regulations.

(c) “Dwelling unit” means a house, double house or duplex, townhouse or row house, apartment or any building intended for occupancy as living quarters by an individual, a family or families or other groups of persons, which living quarters contain a kitchen or other cooking equipment for the exclusive use of the occupant or occupants.

(d) “Improvement” means repair, construction or reconstruction, including alterations and additions, having the effect of rehabilitating a structure so that it becomes habitable or attains higher standards of housing safety, health or amenity or is brought into compliance with laws, ordinances or regulations governing housing standards. Ordinary upkeep and maintenance shall not be deemed an improvement.

(e) “New residential construction” means the building or erection of dwelling units, as defined above, upon vacant land or land specifically prepared to receive such structures after the effective date of this chapter.

(f) “Deteriorated area and/or deteriorated neighborhood” means the area or areas designated by Lawrence Park Township at a public hearing held for the purpose of so designating an area or areas.

892.02 TITLE

This document is a Local Economic Revitalization Tax Assistance chapter and shall be known and cited as the “Lawrence Park Township LERTA Ordinance.”

892.03 INVESTMENT OPPORTUNITY AREA

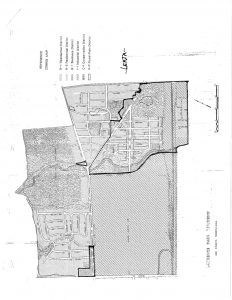

The following specific properties encompass the Investment Opportunity Area of the Lawrence Park Township LERTA Ordinance. These properties are delineated by their Erie County Assessment Reference Numbers. Any division into smaller lots shall also be included in the Lawrence Park Township LERTA District.

892.04 EXEMPTIONS

(a) Generally. There is hereby exempted from all property taxation the assessed valuation of improvements to deteriorated commercial and residential properties and the assessed valuation of new residential construction, in accordance with the provisions and limitations as hereinafter provided.

(b) Limitations

(1) The exemption from real property taxes shall be limited as follows:

(A) Deteriorated Commercial Property. To that portion of the additional assessment attributed to the actual cost of improvements.

(B) New Residential Construction. To that portion of the additional assessment attributed to the actual cost of construction, but not in excess of the maximum cost per dwelling unit as specified in paragraph (b)(2) hereof.

(C) Deteriorated Residential Property. To that portion of the additional assessment attributed to the actual cost of improvement, but not in excess of the maximum cost per dwelling unit as specified in paragraph (b)(2) hereof.

(2) The maximum cost per dwelling unit eligible for exemption shall be fifty thousand dollars ($50,000.00) on the assessment attributable to the actual cost of new construction constructed after the effective date of this chapter. The maximum cost for improvements constructed during each year thereafter shall be the maximum cost for the preceding year, multiplied by the ratio of the United Sates Bureau of the Census new one-family houses price index for the current year to such index for the preceding year. The date of the construction shall be the date of issuance of the building permit, improvement record or other required notification of construction. No tax exemption shall be granted under the provisions of this chapter for any improvements to any dwelling unit in excess of the maximum cost specified above. This limitation shall not apply to nonresidential, industrial, commercial or other business properties which are eligible for exemption under this chapter.

(3) After the effective date of this chapter, where deteriorated commercial or residential property is damaged, destroyed or demolished, by any cause or for any reason, and the assessed valuation of the property affected has been reduced as a result of the said damage, destruction or demolition, the exemption from real property taxation authorized by this chapter shall be abated in proportion to the percentage of the damage, destruction or demolition.

(4) No tax exemption shall be granted if the property owner does not secure the necessary and proper permits prior to improving the property. No tax exemption shall be granted if the property as completed does not comply with the minimum standards of Building and Housing Code of the Township.

(c) Schedules

(1) The schedules for real estate taxes to be exempted shall be as follows:

(A) Deteriorated Commercial Property. For the first five years during which the improvement becomes assessable, 100 percent of the eligible assessment shall be exempted.

(B) New Residential Construction. For the first seven years during which the improvement becomes assessable, the following shall apply:

— First through fifth year – 60 percent exemption

— Sixth year – 10 percent exemption

— Seventh year – 20 percent exemption

(C) Deteriorated Residential Property. For the first five years during which the improvement becomes assessable, the following shall apply:

— First year – 100 percent exemption

— Second year – 80 percent exemption

— Third year – 60 percent exemption

— Fourth year – 40 percent exemption

— Fifth year – 20 percent exemption

(2) The exemption shall commence in the tax year immediately following the year in which the building permit is issued.

(3) The exemption from taxes granted under this chapter shall be upon the property and shall not terminate upon the sale or exchange of the property.

(4) If an eligible property is granted tax exemption pursuant to this chapter, the improvement shall not, during the exemption period, be considered as a factor in assessing other properties.

(d) Procedure. The County Executive of Erie County shall develop the guidelines and procedures to implement this chapter within sixty days of its adoption.

892.05 NONCONFORMING USES EXCLUDED

This chapter and the exemptions granted herein shall not apply to properties which are, according to the municipality in which the properties are located, nonconforming uses.

The following specific properties encompass the Investment Opportunity Area of the Lawrence Park Township LERTA Ordinance. These properties are delineated by their Erie County Assessment Reference Numbers. Any division into smaller lots shall also be included in the Lawrence Park Township LERTA District.